The growth of the global economy and the environmental challenges facing the world have reinforced the importance of supporting long-term sustainable solutions. Priveq is convinced that in our ownership role we can make a difference and will invest in sustainability to continue to be involved in creating growth companies with future-proof business models.

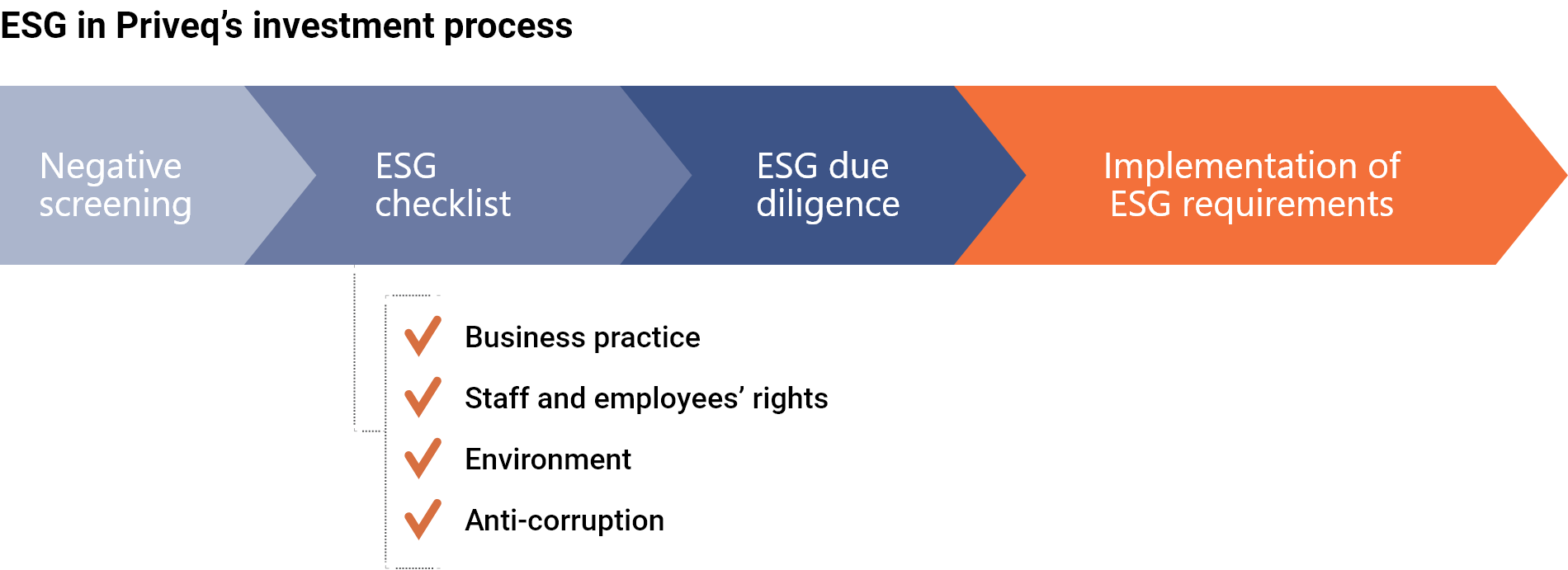

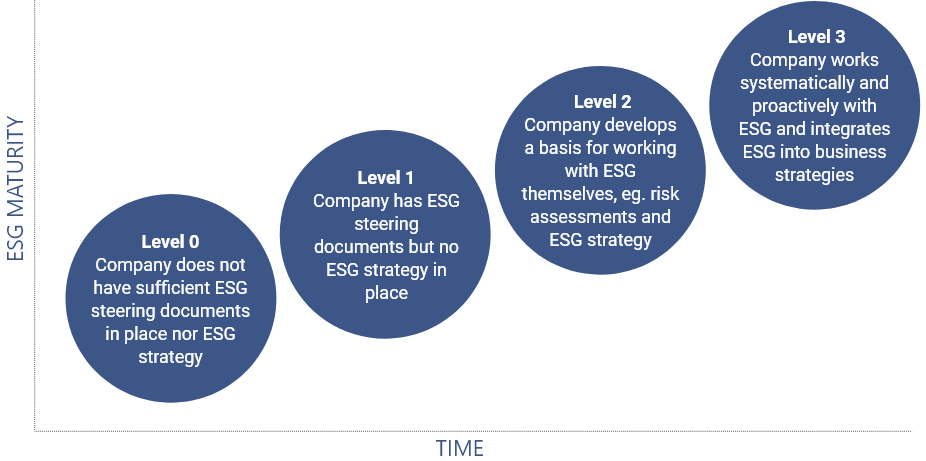

At Priveq, we believe that no one can do everything, but everyone can do something. In our ownership role, we encourage all our portfolio companies to develop their own ESG strategy and have a model that aims to both minimize risk and take advantage of business opportunities. This is done by looking at the areas where the company has the greatest ability to influence and where they have an expectation that they will act. For some companies, this means reducing their climate impact, but it can also be to establish a more sustainable supply chain or, through innovation, develop products that solve their customers’ problems in the area of sustainability.

Priveq is a member of the industry organizations Invest Europe and SVCA (Swedish Venture Capital Association) and is committed to following their guidelines regarding ethics and codes of conduct. Priveq has also joined the Principles for Responsible Investments (UN PRI), a UN initiative to promote responsible investment.

Our work within ESG is fully described in our latest sustainability report.